All Categories

Featured

Table of Contents

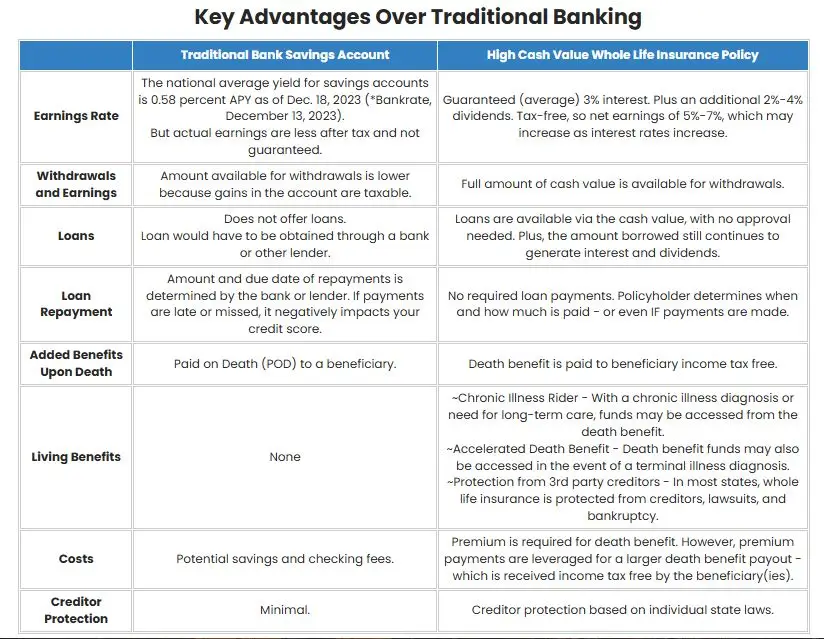

The drawbacks of limitless financial are frequently forgotten or not discussed in all (much of the details available about this principle is from insurance policy agents, which might be a little prejudiced). Just the cash money value is expanding at the dividend rate. You additionally need to spend for the price of insurance, charges, and expenditures.

Every permanent life insurance policy is different, yet it's clear a person's overall return on every dollar spent on an insurance coverage item might not be anywhere close to the dividend rate for the plan.

Infinite Banking Spreadsheet

To provide a very fundamental and hypothetical instance, allow's assume somebody is able to earn 3%, usually, for every buck they invest in an "infinite financial" insurance policy item (besides costs and costs). This is double the approximated return of entire life insurance policy from Consumer Reports of 1.5%. If we assume those bucks would certainly be subject to 50% in tax obligations complete otherwise in the insurance coverage product, the tax-adjusted rate of return can be 4.5%.

We presume greater than average returns on the whole life item and an extremely high tax rate on dollars not put right into the plan (that makes the insurance policy item look far better). The truth for numerous individuals may be even worse. This pales in comparison to the long-term return of the S&P 500 of over 10%.

Infinite financial is an excellent item for agents that sell insurance coverage, but may not be optimum when compared to the less costly alternatives (without any sales individuals earning fat payments). Here's a break down of a few of the other purported advantages of boundless banking and why they may not be all they're split up to be.

Become My Own Bank

At the end of the day you are acquiring an insurance item. We enjoy the protection that insurance policy supplies, which can be obtained much less expensively from a low-cost term life insurance policy policy. Unpaid fundings from the policy may also minimize your fatality advantage, decreasing one more degree of defense in the policy.

The idea just works when you not just pay the substantial premiums, yet use added money to acquire paid-up additions. The chance cost of all of those bucks is remarkable incredibly so when you can rather be purchasing a Roth IRA, HSA, or 401(k). Also when contrasted to a taxed financial investment account and even a savings account, unlimited financial may not offer equivalent returns (contrasted to investing) and similar liquidity, access, and low/no cost framework (compared to a high-yield interest-bearing accounts).

With the surge of TikTok as an information-sharing system, financial advice and approaches have located a novel method of dispersing. One such approach that has been making the rounds is the unlimited banking principle, or IBC for short, gathering recommendations from celebrities like rap artist Waka Flocka Flame. While the method is presently preferred, its roots trace back to the 1980s when economist Nelson Nash presented it to the world.

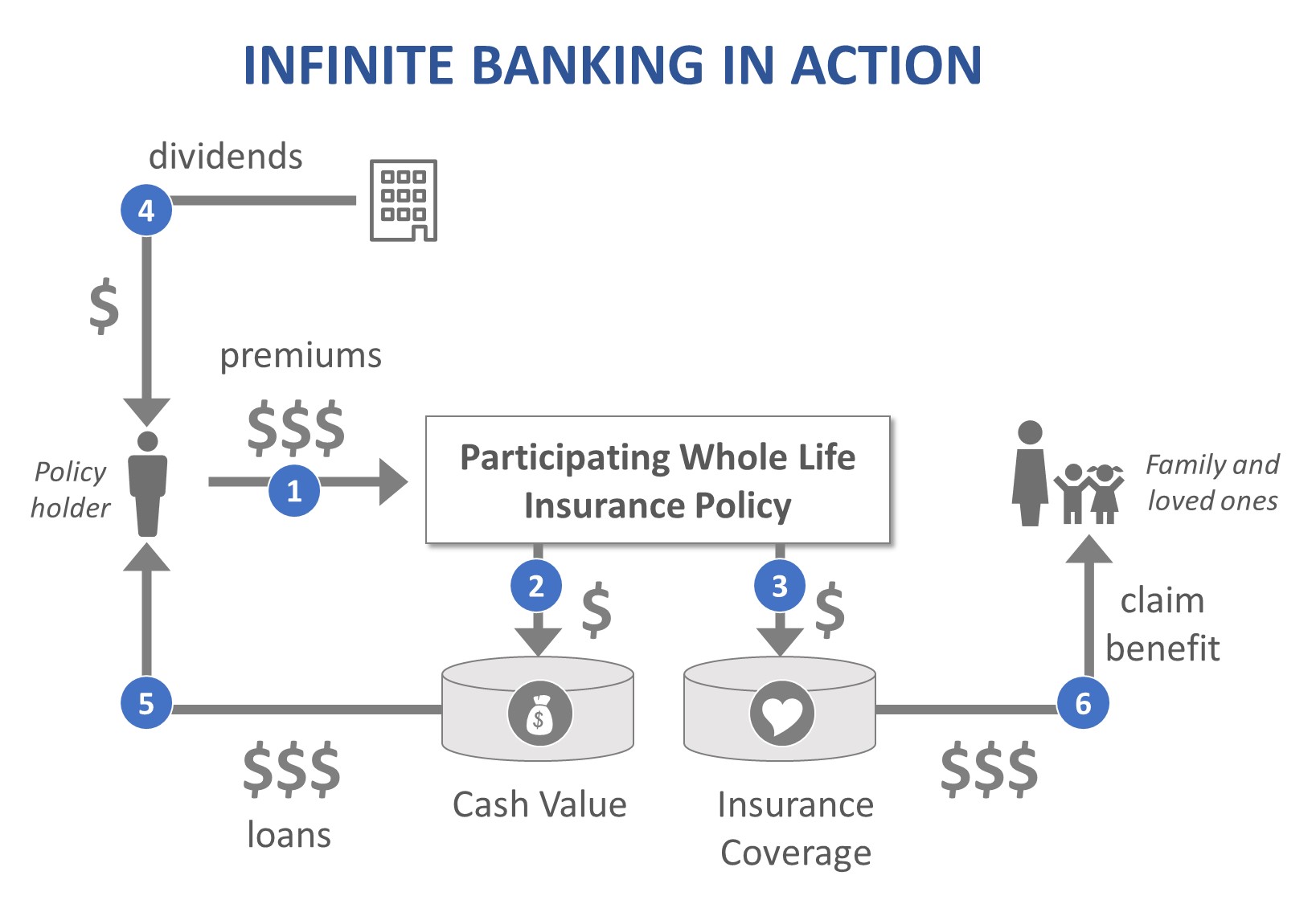

Within these policies, the cash value expands based on a rate set by the insurance firm. When a significant cash worth collects, insurance holders can obtain a money worth car loan. These lendings vary from traditional ones, with life insurance policy functioning as collateral, suggesting one could shed their coverage if borrowing excessively without ample cash worth to sustain the insurance coverage costs.

Synchrony Bank Infinite Credit Card

And while the attraction of these plans is apparent, there are innate constraints and threats, requiring thorough money worth monitoring. The technique's authenticity isn't black and white. For high-net-worth people or entrepreneur, specifically those utilizing techniques like company-owned life insurance (COLI), the benefits of tax breaks and substance development can be appealing.

The attraction of infinite financial does not negate its challenges: Cost: The fundamental demand, an irreversible life insurance policy, is more expensive than its term counterparts. Eligibility: Not everyone gets approved for entire life insurance policy because of extensive underwriting procedures that can omit those with certain wellness or way of life conditions. Complexity and risk: The elaborate nature of IBC, paired with its risks, may deter numerous, specifically when simpler and much less risky options are available.

Assigning around 10% of your monthly earnings to the plan is simply not practical for lots of people. Utilizing life insurance policy as a financial investment and liquidity source needs technique and tracking of policy money value. Speak with an economic consultant to determine if unlimited financial lines up with your top priorities. Component of what you check out below is just a reiteration of what has already been claimed over.

So prior to you obtain into a scenario you're not gotten ready for, know the following initially: Although the principle is typically sold because of this, you're not in fact taking a funding from on your own - using life insurance as a bank. If that held true, you would not have to repay it. Rather, you're obtaining from the insurance provider and have to repay it with passion

What Is A Cash Flow Banking System

Some social media articles recommend using cash money worth from whole life insurance policy to pay down credit card debt. When you pay back the funding, a part of that interest goes to the insurance policy business.

For the first numerous years, you'll be paying off the compensation. This makes it extremely difficult for your policy to accumulate worth throughout this time around. Whole life insurance policy expenses 5 to 15 times more than term insurance. The majority of people merely can't afford it. So, unless you can manage to pay a couple of to several hundred dollars for the following years or more, IBC will not help you.

Not every person needs to depend entirely on themselves for monetary security. If you call for life insurance policy, below are some beneficial tips to take into consideration: Think about term life insurance coverage. These plans give insurance coverage throughout years with significant financial commitments, like home loans, student car loans, or when looking after little ones. Make certain to look around for the best price.

Limitless banking is not a product and services provided by a particular organization. Limitless financial is an approach in which you acquire a life insurance policy plan that builds up interest-earning money worth and take out car loans versus it, "obtaining from on your own" as a resource of capital. At some point pay back the lending and begin the cycle all over once more.

Pay policy premiums, a portion of which develops money value. Cash value makes intensifying rate of interest. Take a financing out versus the plan's cash worth, tax-free. Settle lendings with rate of interest. Cash worth accumulates once more, and the cycle repeats. If you utilize this concept as intended, you're taking money out of your life insurance policy plan to purchase whatever you would certainly need for the rest of your life.

Latest Posts

Infinite Banking Services Usa

Become Your Own Bank - Financial Security Seminar

Infinite Banking Concept Life Insurance