All Categories

Featured

Table of Contents

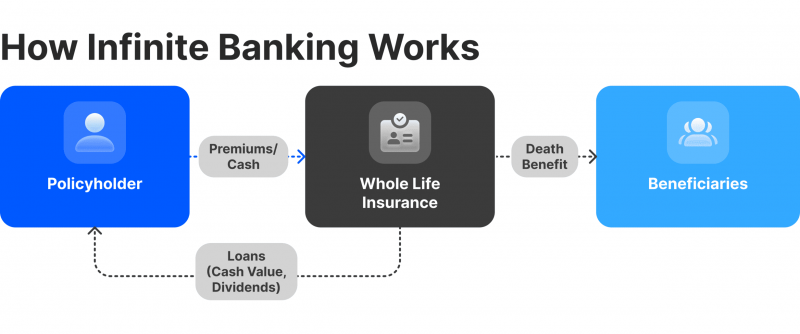

The are whole life insurance policy and global life insurance coverage. The cash value is not included to the death benefit.

After 10 years, the money value has actually expanded to around $150,000. He takes out a tax-free finance of $50,000 to begin a company with his bro. The plan funding rate of interest rate is 6%. He settles the car loan over the next 5 years. Going this route, the passion he pays goes back right into his plan's cash value rather than a monetary institution.

Visualize never having to stress about bank loans or high interest prices once more. That's the power of unlimited banking life insurance coverage.

There's no collection finance term, and you have the flexibility to choose the repayment schedule, which can be as leisurely as repaying the finance at the time of death. This adaptability reaches the maintenance of the loans, where you can select interest-only repayments, maintaining the funding balance level and convenient.

Holding cash in an IUL repaired account being credited interest can commonly be much better than holding the money on deposit at a bank.: You have actually always desired for opening your own pastry shop. You can obtain from your IUL plan to cover the preliminary expenses of renting a room, acquiring tools, and hiring team.

Infinite Banking Toolkit

Personal car loans can be obtained from traditional banks and debt unions. Right here are some bottom lines to consider. Charge card can provide an adaptable way to obtain cash for extremely temporary durations. Nonetheless, borrowing cash on a charge card is usually extremely costly with yearly percentage rates of passion (APR) typically getting to 20% to 30% or even more a year.

The tax obligation therapy of plan fundings can vary substantially depending upon your nation of house and the details terms of your IUL plan. In some areas, such as North America, the United Arab Emirates, and Saudi Arabia, plan fundings are usually tax-free, offering a considerable benefit. Nonetheless, in other territories, there may be tax obligation ramifications to think about, such as potential tax obligations on the lending.

Term life insurance only gives a death benefit, without any type of cash money worth build-up. This means there's no cash money worth to borrow versus.

Infinite Banking Real Estate

When you initially listen to concerning the Infinite Banking Principle (IBC), your very first reaction may be: This appears also great to be real. Probably you're cynical and think Infinite Banking is a fraud or scheme - r nelson nash net worth. We wish to set the record straight! The problem with the Infinite Banking Idea is not the idea yet those individuals using an adverse critique of Infinite Banking as a concept.

As IBC Authorized Practitioners via the Nelson Nash Institute, we assumed we would address some of the top questions people search for online when finding out and comprehending everything to do with the Infinite Banking Principle. What is Infinite Financial? Infinite Banking was created by Nelson Nash in 2000 and fully described with the publication of his publication Becoming Your Own Banker: Unlock the Infinite Banking Idea.

Ibc Nelson Nash

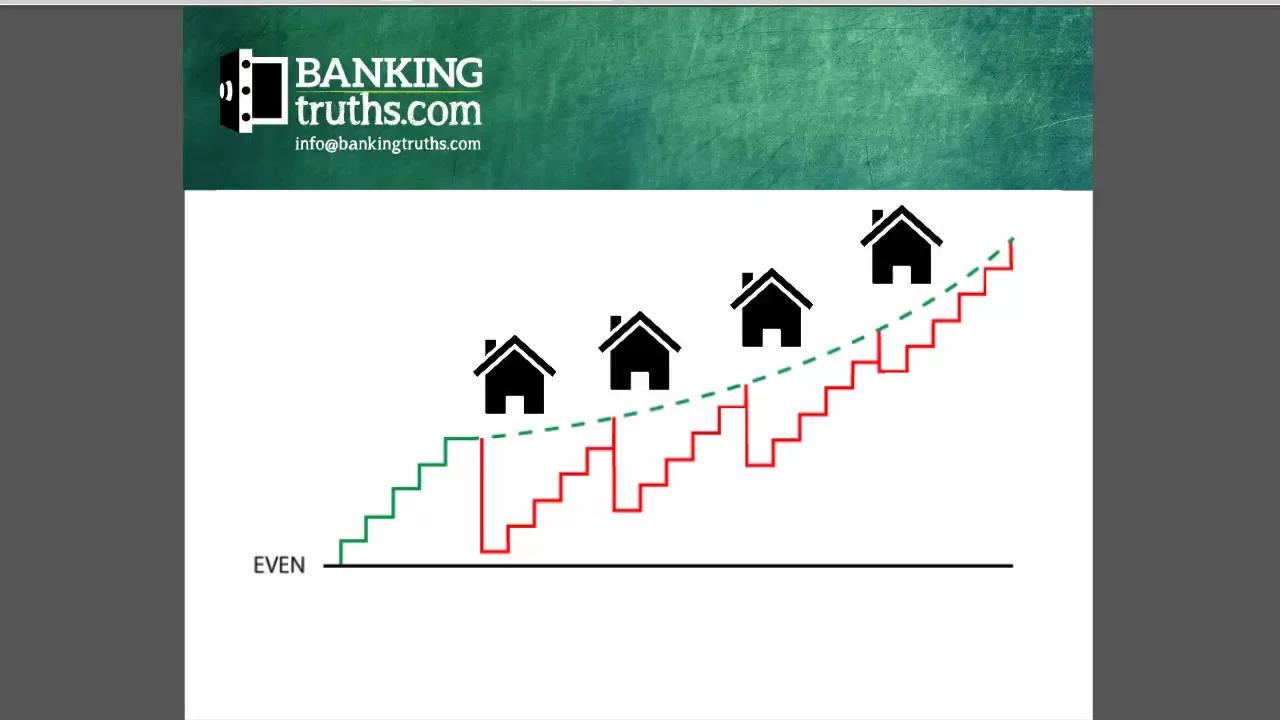

You think you are coming out financially in advance because you pay no rate of interest, but you are not. With conserving and paying money, you might not pay interest, however you are using your money as soon as; when you invest it, it's gone permanently, and you provide up on the opportunity to earn lifetime compound interest on that money.

Even financial institutions use entire life insurance policy for the very same functions. The Canada Earnings Company (CRA) even identifies the value of getting involved whole life insurance coverage as an one-of-a-kind possession class used to create lasting equity safely and predictably and supply tax benefits outside the range of typical investments.

Infinite Banking Concept Pdf

It allows you to produce wide range by fulfilling the financial function in your very own life and the capability to self-finance major way of living acquisitions and costs without disrupting the compound rate of interest. One of the easiest ways to assume about an IBC-type taking part whole life insurance policy plan is it is comparable to paying a home mortgage on a home.

When you borrow from your participating whole life insurance coverage plan, the money worth continues to expand continuous as if you never borrowed from it in the first location. This is since you are making use of the money worth and death benefit as collateral for a car loan from the life insurance policy business or as collateral from a third-party lending institution (recognized as collateral loaning).

That's why it's critical to work with a Licensed Life Insurance Broker authorized in Infinite Banking who structures your participating whole life insurance policy plan appropriately so you can prevent negative tax obligation ramifications. Infinite Financial as an economic strategy is except every person. Below are a few of the advantages and disadvantages of Infinite Banking you need to seriously consider in choosing whether to move on.

Our preferred insurance carrier, Equitable Life of Canada, a mutual life insurance policy firm, focuses on participating entire life insurance policy policies specific to Infinite Financial. Additionally, in a shared life insurance policy company, insurance policy holders are taken into consideration firm co-owners and receive a share of the divisible surplus created each year through returns. We have a range of service providers to select from, such as Canada Life, Manulife and Sunlight Lifedepending on the demands of our customers.

Please also download our 5 Top Inquiries to Ask A Boundless Banking Agent Before You Hire Them. To find out more about Infinite Financial check out: Please note: The product given in this newsletter is for informative and/or instructional functions only. The details, opinions and/or sights revealed in this newsletter are those of the writers and not necessarily those of the representative.

Can I Be My Own Bank

Nash was a financing specialist and fan of the Austrian institution of economics, which supports that the value of items aren't explicitly the result of standard economic frameworks like supply and demand. Rather, people value cash and items in different ways based on their financial status and demands.

One of the pitfalls of typical banking, according to Nash, was high-interest prices on finances. Too several individuals, himself included, got right into monetary trouble due to dependence on financial organizations.

Infinite Banking requires you to own your economic future. For ambitious people, it can be the best financial tool ever before. Below are the benefits of Infinite Banking: Perhaps the single most helpful facet of Infinite Financial is that it improves your cash money flow.

Dividend-paying whole life insurance policy is really reduced threat and supplies you, the insurance holder, a fantastic bargain of control. The control that Infinite Banking uses can best be grouped right into two classifications: tax obligation advantages and asset defenses. Among the reasons entire life insurance is perfect for Infinite Banking is how it's exhausted.

Whole life insurance coverage plans are non-correlated assets. This is why they work so well as the monetary foundation of Infinite Financial. No matter what takes place in the market (stock, actual estate, or otherwise), your insurance plan maintains its well worth. A lot of people are missing out on this necessary volatility buffer that assists protect and expand wide range, instead breaking their cash right into two pails: savings account and financial investments.

Whole life insurance coverage is that 3rd container. Not just is the price of return on your entire life insurance coverage policy guaranteed, your fatality advantage and costs are also assured.

How Infinite Banking Works

This framework lines up flawlessly with the principles of the Continuous Wide Range Method. Infinite Banking interest those looking for higher monetary control. Here are its primary advantages: Liquidity and ease of access: Policy finances supply immediate access to funds without the restrictions of standard bank car loans. Tax obligation performance: The cash value grows tax-deferred, and policy car loans are tax-free, making it a tax-efficient tool for building riches.

Property defense: In numerous states, the money value of life insurance coverage is secured from financial institutions, adding an added layer of financial security. While Infinite Banking has its values, it isn't a one-size-fits-all option, and it features considerable drawbacks. Right here's why it might not be the most effective strategy: Infinite Banking typically requires detailed policy structuring, which can puzzle policyholders.

Latest Posts

Infinite Banking Services Usa

Become Your Own Bank - Financial Security Seminar

Infinite Banking Concept Life Insurance